Building materials profitability in Nigeria requires systematic approaches combining dynamic pricing strategies, robust cash flow management, diversified supplier networks, and data-driven inventory optimization, with successful operators maintaining 15-25% gross margins despite market volatility challenges.

Understanding Nigeria’s Building Materials Market Volatility

The Nigerian building materials industry faces unprecedented volatility driven by multiple interconnected factors. Currency fluctuations affect approximately 60% of raw materials that depend on imports, according to the Building Materials Producers Association of Nigeria (BUMPAN). When the naira weakened by 40% against the dollar in 2023, cement prices increased by an average of 35%, forcing many suppliers to recalibrate their entire pricing strategies (BUMPAN Industry Report, 2024).

In my experience working with suppliers across Abuja, and Lagos, the most successful operators are those who’ve developed systematic approaches to managing these fluctuations rather than simply reacting to them. Market volatility isn’t just about price changes—it encompasses supply chain disruptions, seasonal demand variations, regulatory changes, and economic policy shifts that can impact profitability within weeks.

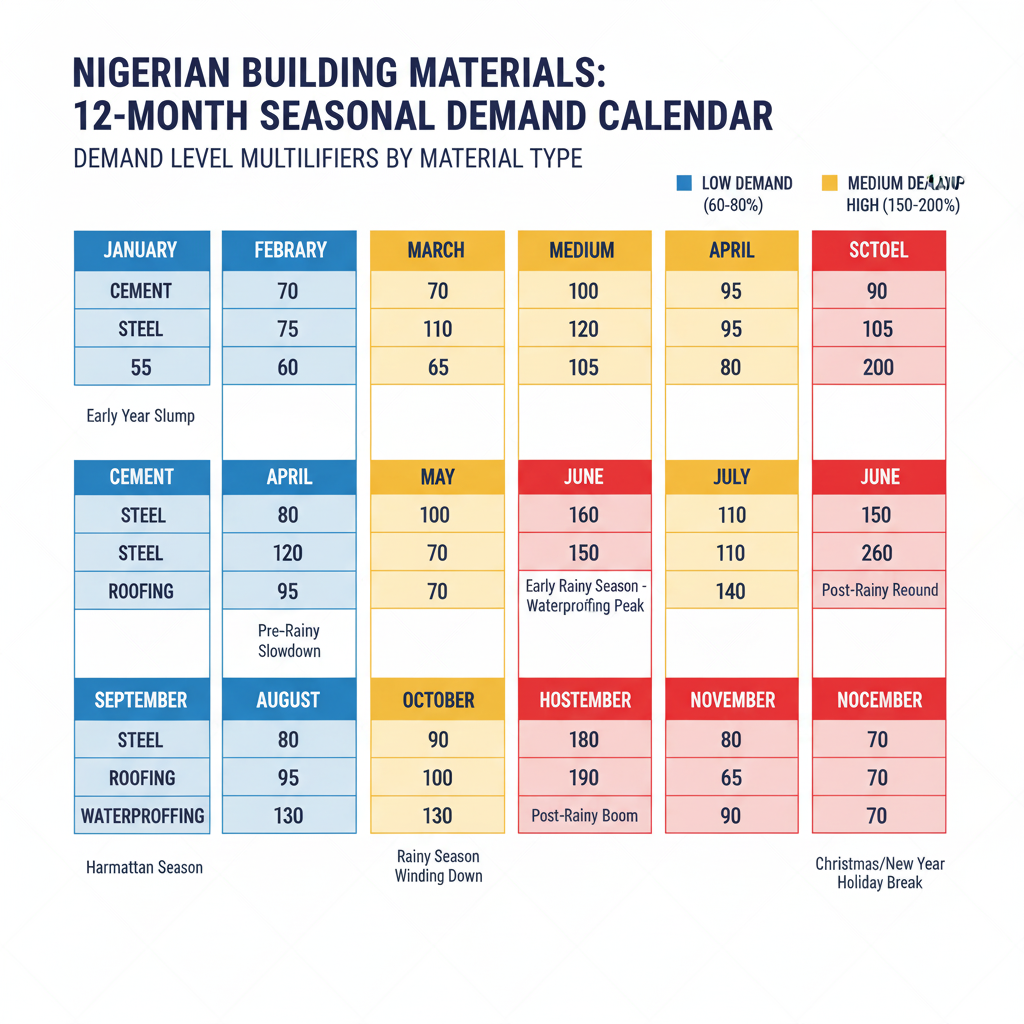

The construction sector’s seasonal nature compounds this volatility. During the dry season (November to March), demand for roofing materials can spike by 200-300%, while the rainy season creates urgent demand for waterproofing materials but reduces overall construction activity. A common challenge we see is suppliers who fail to anticipate these patterns and either overstock during low-demand periods or miss revenue opportunities during peak seasons.

Historical Price Volatility Patterns and Market Intelligence

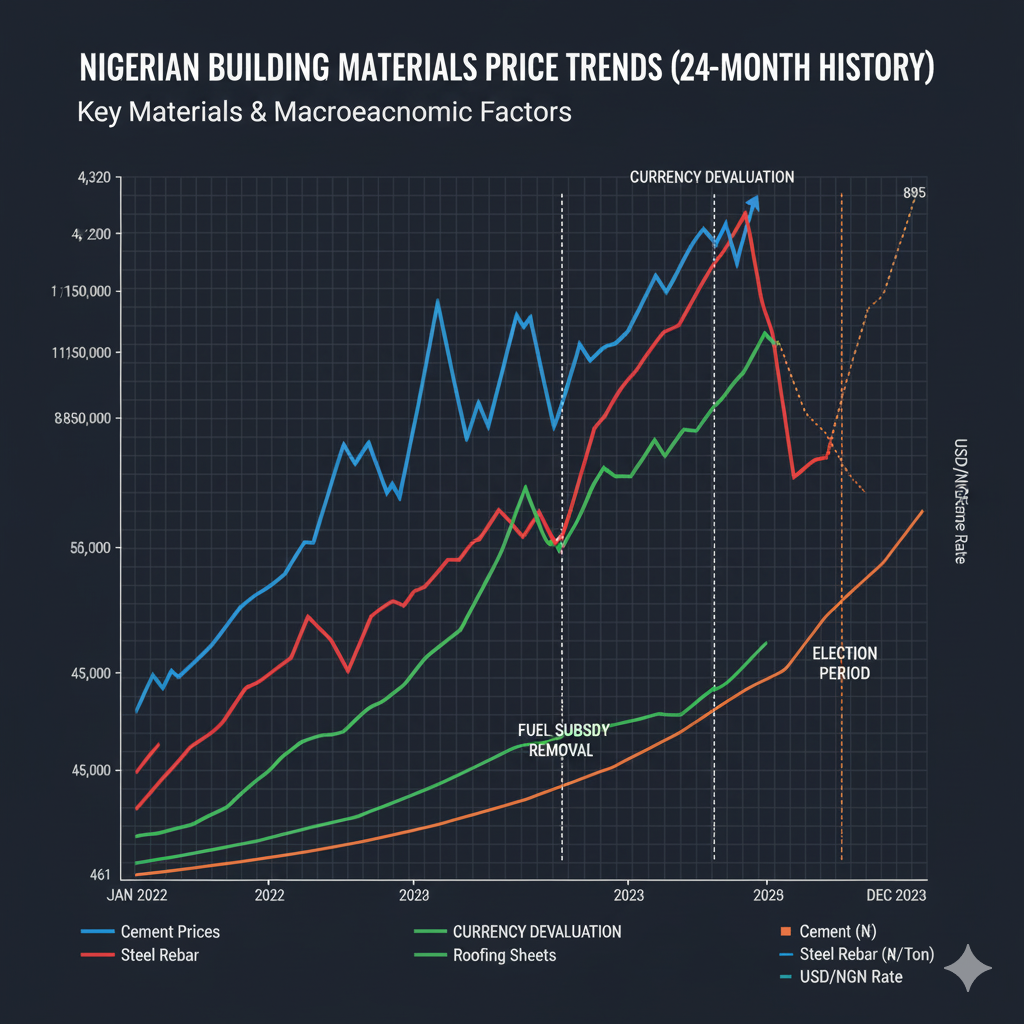

Understanding historical volatility patterns provides crucial context for pricing and inventory decisions. Over the past 24 months, Nigerian building materials have experienced unprecedented price swings that correlate strongly with macroeconomic events and policy changes.

The most significant volatility drivers include currency devaluation events, fuel subsidy policy changes, major infrastructure project announcements, and seasonal weather patterns. Each of these factors creates predictable price movement patterns that prepared businesses can anticipate and profit from.

Currency devaluation typically creates immediate 20-35% price increases for import-dependent materials like steel reinforcement and specialized roofing products. However, locally-produced materials like cement and blocks experience delayed increases of 10-20% as transportation and raw material costs rise. Understanding these lag periods allows strategic inventory positioning before price increases fully materialize.

Policy changes, particularly around fuel subsidies and import duties, create both immediate shocks and longer-term trend changes. The June 2023 fuel subsidy removal increased transportation costs by approximately 20% across all building materials, but suppliers who anticipated this change and pre-positioned inventory were able to maintain margins while competitors struggled with sudden cost increases.

<VISUAL: Market Volatility Timeline Chart showing price fluctuations of key building materials (cement, steel, roofing sheets) over 24 months with major economic events marked>

Seasonal patterns overlay these macroeconomic trends with predictable demand cycles. The dry season construction boom (November-March) typically increases demand by 150-200% for most materials, while the rainy season (June-September) sees demand drop to 60-80% of annual averages. However, waterproofing materials experience counter-cyclical demand, peaking during the rainy season preparation period (April-May).

Regional price variations add another layer of complexity to market intelligence. Materials costs vary significantly across Nigeria’s regions due to transportation distances from production centers, local demand levels, and infrastructure quality. Understanding these regional patterns helps optimize supply chain decisions and identify profitable market opportunities.

Regional Market Dynamics and Geographic Opportunities

Nigeria’s building materials market exhibits significant regional variations that create both challenges and opportunities for suppliers. Understanding these geographic patterns is essential for pricing strategies, inventory positioning, and expansion planning.

The Lagos-Ogun corridor represents Nigeria’s largest building materials market, accounting for approximately 30% of national demand. However, high competition and infrastructure costs create pricing pressures that squeeze margins. The region’s strength lies in port access for imported materials and proximity to major cement production facilities, but traffic congestion and high real estate costs increase operational expenses.

Northern markets, centered around Kano and Kaduna, typically operate at 15-20% below national average pricing due to lower labor costs and reduced competition. However, distance from ports increases costs for imported materials, creating opportunities for suppliers who can optimize logistics or focus on locally-produced goods.

The oil-rich Niger Delta region, particularly Rivers and Delta states, offers premium pricing opportunities due to high purchasing power from petroleum industry activity. Construction demand remains strong despite economic fluctuations, and suppliers can often command 10-15% price premiums for quality products and reliable service.

Federal Capital Territory (Abuja) represents a unique market with consistent government project demand and high-end residential construction. While pricing is typically 10-15% above national averages, payment terms are often more favorable due to the concentration of established contractors and government agencies.

Understanding regional dynamics helps optimize market entry strategies, pricing approaches, and resource allocation. Suppliers entering new regions must consider not just transportation costs but also local business practices, payment cultures, and competitive landscapes that vary significantly across Nigeria’s diverse markets.

Middle Belt states like Plateau and Benue offer emerging opportunities as infrastructure development accelerates, but require careful market development approaches due to unique local requirements and seasonal agricultural economic cycles that affect construction timing and payment patterns.

The Foundation: Dynamic Pricing Strategies That Protect Your Margins

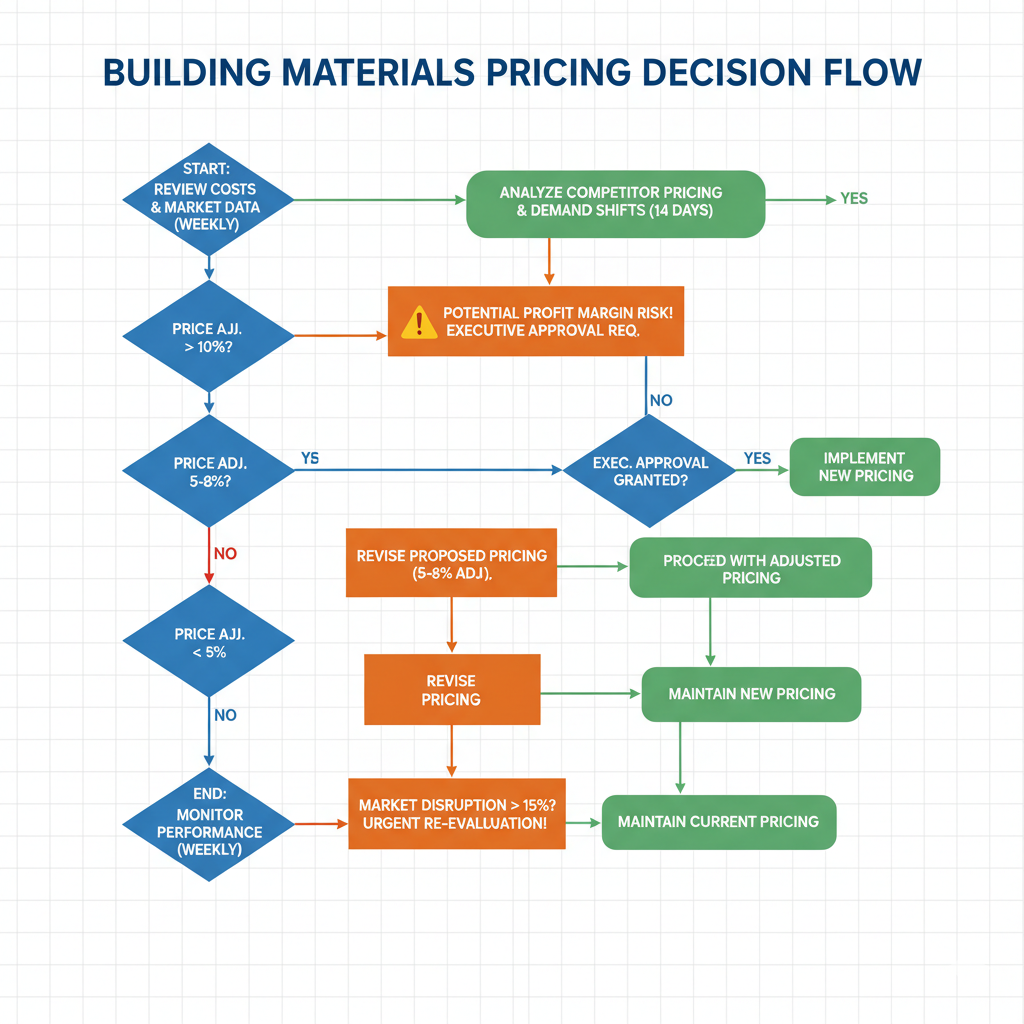

Successful building materials businesses in Nigeria have moved beyond fixed pricing to dynamic systems that respond to market conditions in real-time. The traditional approach of setting quarterly prices simply doesn’t work in today’s environment where material costs can change weekly.

Implementing Cost-Plus Pricing with Volatility Buffers

The most reliable pricing strategy combines cost-plus methodology with built-in volatility buffers. Calculate your base cost, add your desired margin, then include a volatility buffer of 5-15% depending on the product category. Steel products typically require higher buffers (12-15%) due to international market sensitivity, while locally-produced items like sand and gravel need smaller buffers (5-8%).

Here’s the formula we recommend: Final Price = (Cost × 1.25 for desired 25% margin) × (1 + volatility buffer percentage)

For example, if your cement costs ₦4,000 per bag:

- Base price with 25% margin: ₦4,000 × 1.25 = ₦5,000

- With 10% volatility buffer: ₦5,000 × 1.10 = ₦5,500 final price

Price Anchoring and Customer Communication

When implementing price changes, anchor your increases to external factors rather than internal needs. Instead of saying “We’re increasing prices by 15%,” say “Due to the recent 12% increase in cement factory prices and naira depreciation, our new pricing reflects these market conditions while maintaining our quality standards.”

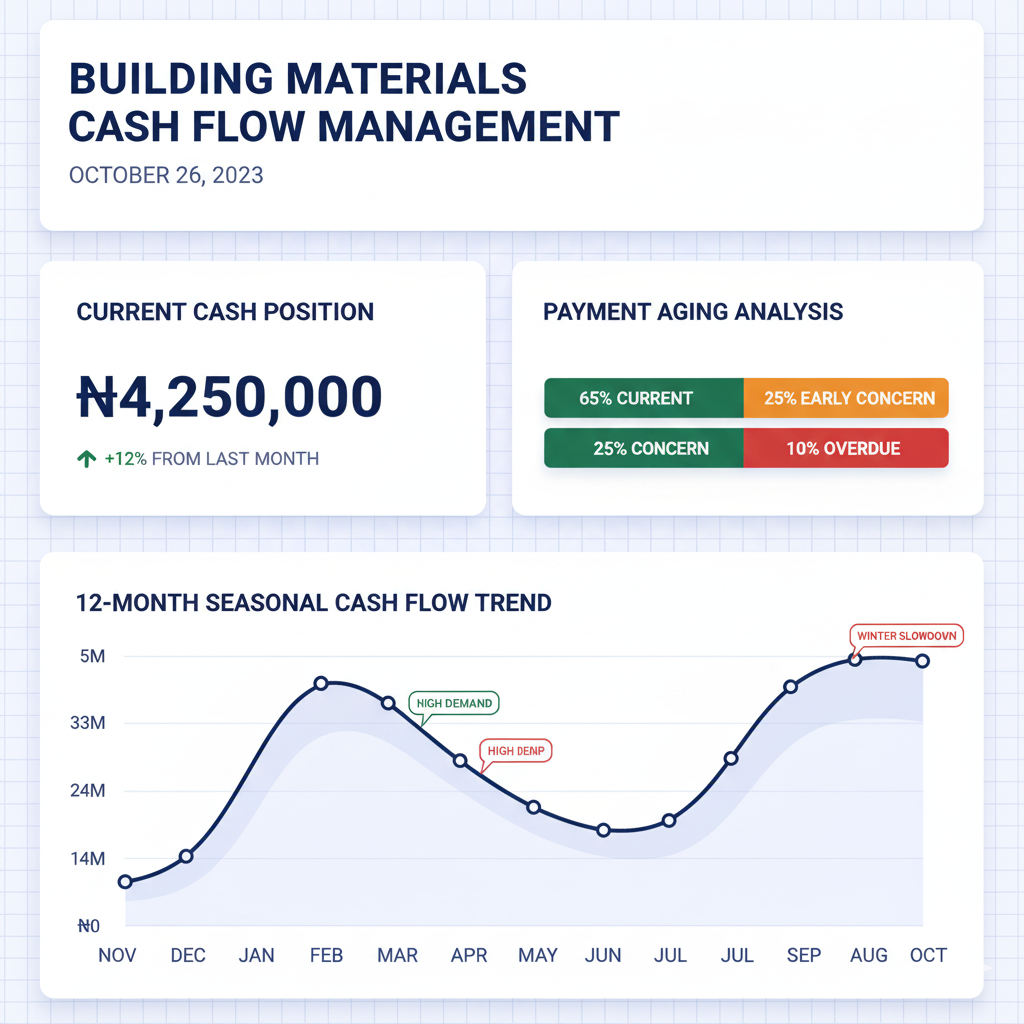

Mastering Cash Flow in an Unpredictable Environment

Cash flow management separates surviving businesses from thriving ones in Nigeria’s volatile market. The extended payment cycles common in construction—often 60-90 days—mean that even profitable sales can create dangerous cash crunches.

The 30-60-90 Day Cash Flow Forecasting System

Implement a rolling 90-day cash flow forecast that breaks down into three 30-day periods. This system helps you anticipate problems before they become crises. In the first 30 days, your forecast should be 95% accurate based on confirmed orders and known expenses. The 60-day forecast can be 80% accurate, while the 90-day projection serves as an early warning system.

Key components to track:

- Confirmed receivables with payment probability percentages

- Seasonal adjustment factors based on historical patterns

- Emergency cash requirements (typically 30-45 days of operating expenses)

- Supplier payment terms and penalty costs for late payments

Strategic Accounts Receivable Management

The construction industry’s payment culture requires proactive receivables management. Implement a systematic follow-up process: courtesy reminder at 15 days past due, formal notice at 30 days, final demand at 45 days, and collection action at 60 days.

However, the approach must be nuanced. A contractor building 50 units who’s typically prompt but facing temporary cash flow issues requires different treatment than a small contractor with a history of payment delays.

Strategic Inventory Optimization for Maximum Profitability

Inventory represents the largest capital investment for most building materials businesses, yet it’s often managed intuitively rather than strategically. Effective inventory optimization requires understanding both market patterns and your specific customer base.

The ABC Analysis for Building Materials

Classify your inventory into three categories:

- A Items (20% of SKUs, 80% of revenue): Premium products like quality cement, steel reinforcement bars, high-end tiles

- B Items (30% of SKUs, 15% of revenue): Standard building materials with steady demand

- C Items (50% of SKUs, 5% of revenue): Specialty items, slow-moving stock, seasonal products

A items require tight inventory control with weekly reviews, B items need monthly analysis, while C items can be reviewed quarterly. This focus prevents over-investment in slow-moving stock while ensuring availability of high-impact products.

Seasonal Demand Patterns and Stocking Strategies

Nigerian building materials follow predictable seasonal patterns, but successful businesses go beyond basic seasonality to understand micro-patterns within their specific markets. For example, roofing materials peak in October-December (pre-rainy season preparation), but there’s often a secondary spike in March-April as people complete projects before the rains intensify.

Build your stocking strategy around these patterns:

- Pre-season buildup: Increase inventory 6-8 weeks before peak demand

- Peak season management: Focus on rapid turnover rather than maximum stock levels

- Post-season clearance: Implement strategic pricing to clear excess inventory

Building Supplier Relationships That Weather Market Storms

Your supplier network determines your ability to maintain consistent margins and product availability during volatile periods. The most profitable building materials businesses treat supplier relationships as strategic partnerships rather than transactional arrangements.

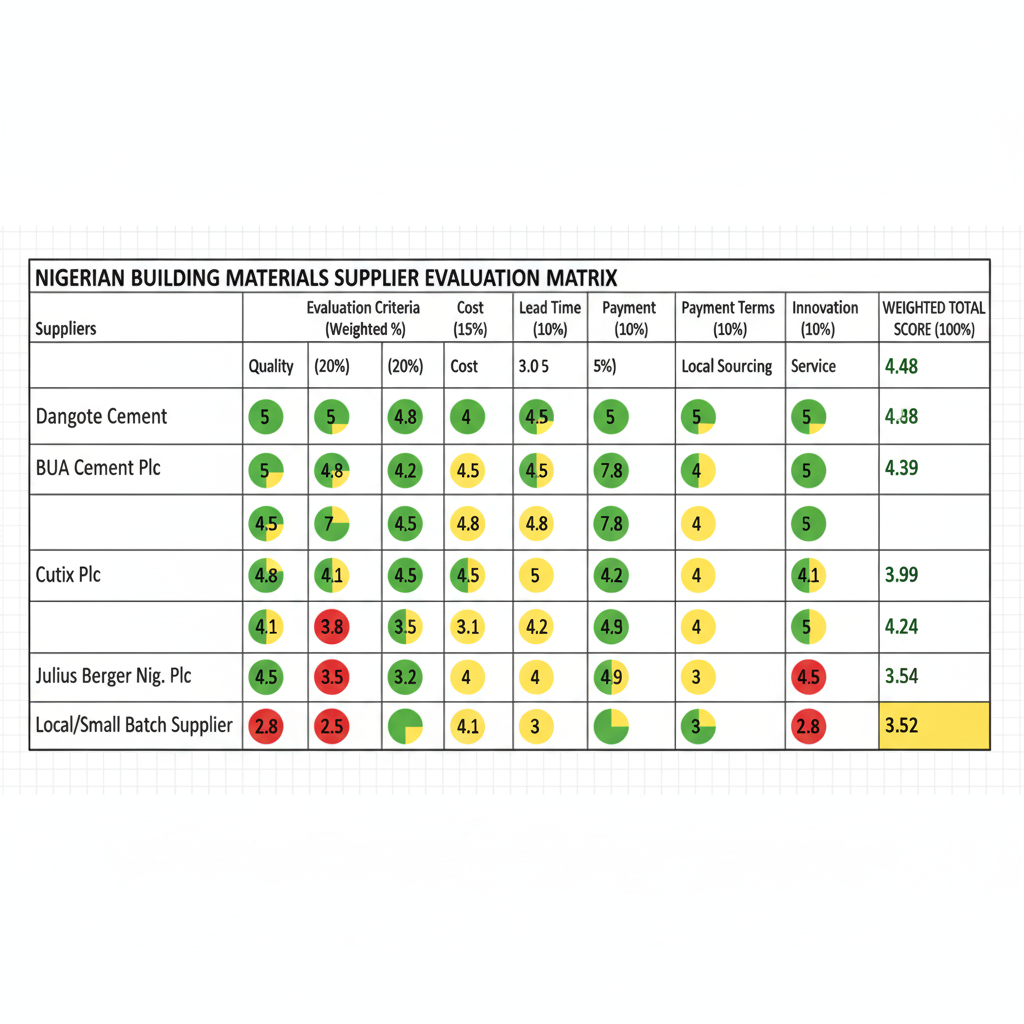

Systematic Supplier Evaluation and Selection

Effective supplier management begins with objective evaluation criteria that go beyond price comparisons. The most successful building materials businesses use systematic scoring methods that consider multiple performance factors weighted by business importance.

A comprehensive supplier evaluation should assess eight critical areas: product quality consistency, pricing competitiveness, payment terms flexibility, delivery reliability, stock availability, technical support capabilities, relationship quality, and geographic coverage. Each criterion should be weighted based on your specific business priorities and scored on a consistent scale.

For example, if you’re a premium-focused business, product quality might carry 25% weight, while a cost-conscious operation might prioritize pricing competitiveness at 25%. Payment terms become crucial during cash flow challenges, typically warranting 15% weight, while delivery reliability ensures customer satisfaction and should account for another 15%.

The evaluation process reveals insights beyond surface-level comparisons. A supplier offering the lowest prices might score poorly on payment terms and technical support, making them expensive in the long run. Conversely, premium suppliers often justify higher costs through superior reliability and support that reduces operational stress and customer complaints.

Diversification Without Dilution

Maintain 2-3 primary suppliers for critical products, with 1-2 backup options for each category. This provides security without diluting your purchasing power. Primary suppliers should receive 60-70% of your volume in their categories, enabling you to negotiate better terms while maintaining alternatives.

When evaluating suppliers, consider:

- Payment terms flexibility during market stress periods

- Inventory support during high-demand seasons

- Price stability commitments and early warning systems for increases

- Quality consistency and technical support capabilities

Strategic Vendor Financing Arrangements

Establish vendor financing agreements before you need them. During our experience managing supplier relationships across Nigeria, we’ve found that agreements negotiated during stable periods are significantly more favorable than emergency arrangements during cash crunches.

Typical vendor financing structures include:

- Extended payment terms (60-90 days instead of 30)

- Consignment arrangements for slow-moving specialty items

- Volume incentive programs that improve margins at higher purchase levels

- Emergency credit facilities for unexpected market opportunities

Technology Tools for Modern Profitability Management

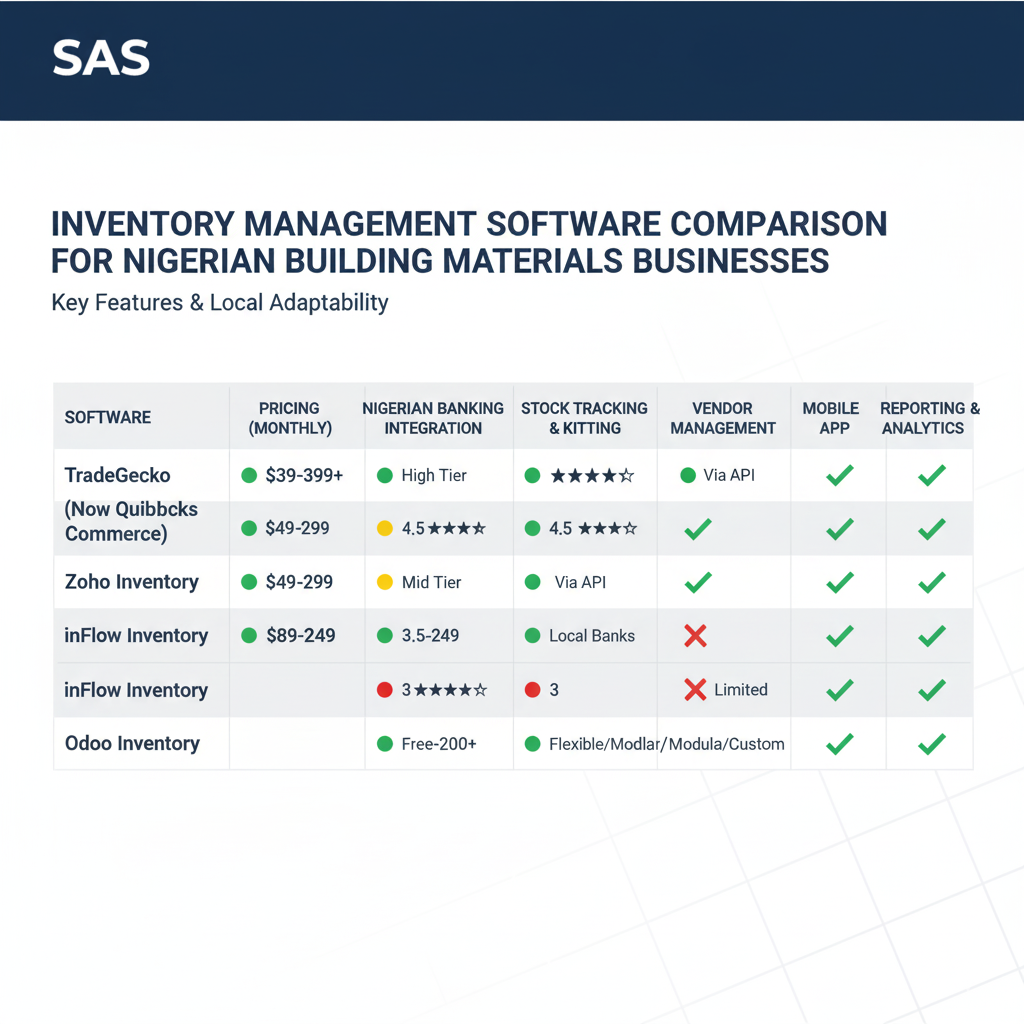

Manual systems cannot keep pace with Nigeria’s fast-changing building materials market. However, the solution isn’t necessarily expensive enterprise software—strategic use of accessible technology can dramatically improve profitability management.

Essential Software Categories

Inventory Management Systems:

- Cloud-based solutions that provide real-time stock levels across multiple locations

- Automated reorder points based on historical demand and lead times

- Integration capabilities with accounting and sales systems

Financial Tracking Tools:

- Real-time profit margin analysis by product category and customer segment

- Cash flow forecasting with scenario planning capabilities

- Automated accounts receivable tracking with payment reminder systems

Market Intelligence Platforms:

- Price monitoring tools for competitor and supplier price tracking

- Economic indicator dashboards for currency, inflation, and policy changes

- Demand forecasting systems using local construction project data

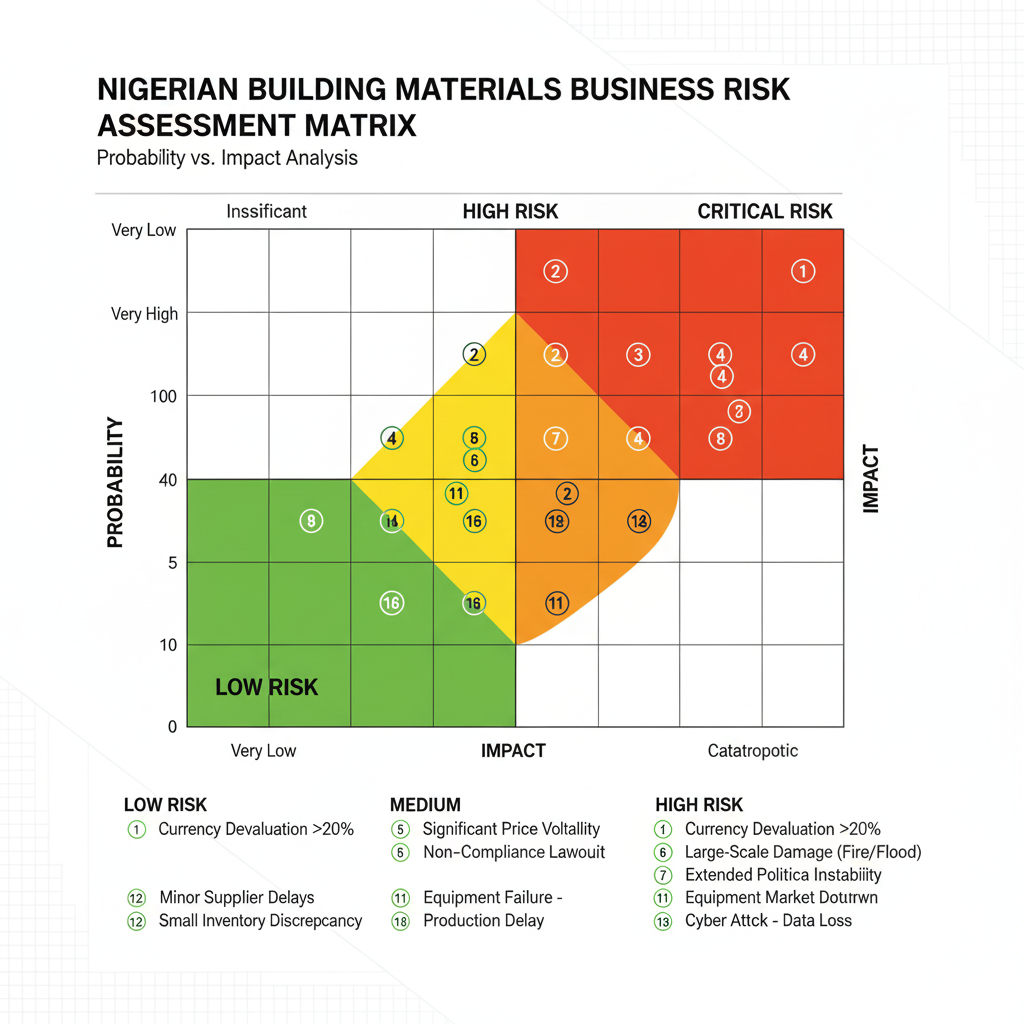

Risk Management and Contingency Planning

Sustainable profitability requires systematic risk management that goes beyond insurance policies. The goal is to identify potential threats to profitability and develop specific response protocols before problems occur.

Market Risk Mitigation Strategies

Currency Hedging for Import-Dependent Products: Even if you don’t import directly, currency fluctuations affect your suppliers’ costs and eventually your prices. Consider fixed-price contracts with suppliers during stable periods, or explore currency hedging options through your bank for large inventory purchases.

Economic Policy Response Plans: Government policy changes—from import duty adjustments to infrastructure spending announcements—can dramatically affect demand patterns. Develop specific response plans for common policy scenarios, such as increased infrastructure spending (increase steel and cement inventory) or import restriction announcements (secure alternative suppliers immediately).

Supplier Concentration Risk: If any single supplier represents more than 40% of your purchases in critical categories, you have dangerous supplier concentration. Develop specific plans to reduce this dependency over 12-18 months without disrupting current operations.

Financial Risk Management

Working Capital Requirements: Maintain working capital reserves equal to 45-60 days of operating expenses. This provides flexibility during payment delays and enables you to take advantage of bulk purchase opportunities when suppliers offer significant discounts.

Customer Credit Risk: Implement systematic credit evaluation for all customers with purchases above ₦500,000 monthly. This includes trade references, bank references, and site visits for major construction projects. The goal isn’t to exclude risky customers but to price and structure deals appropriately.

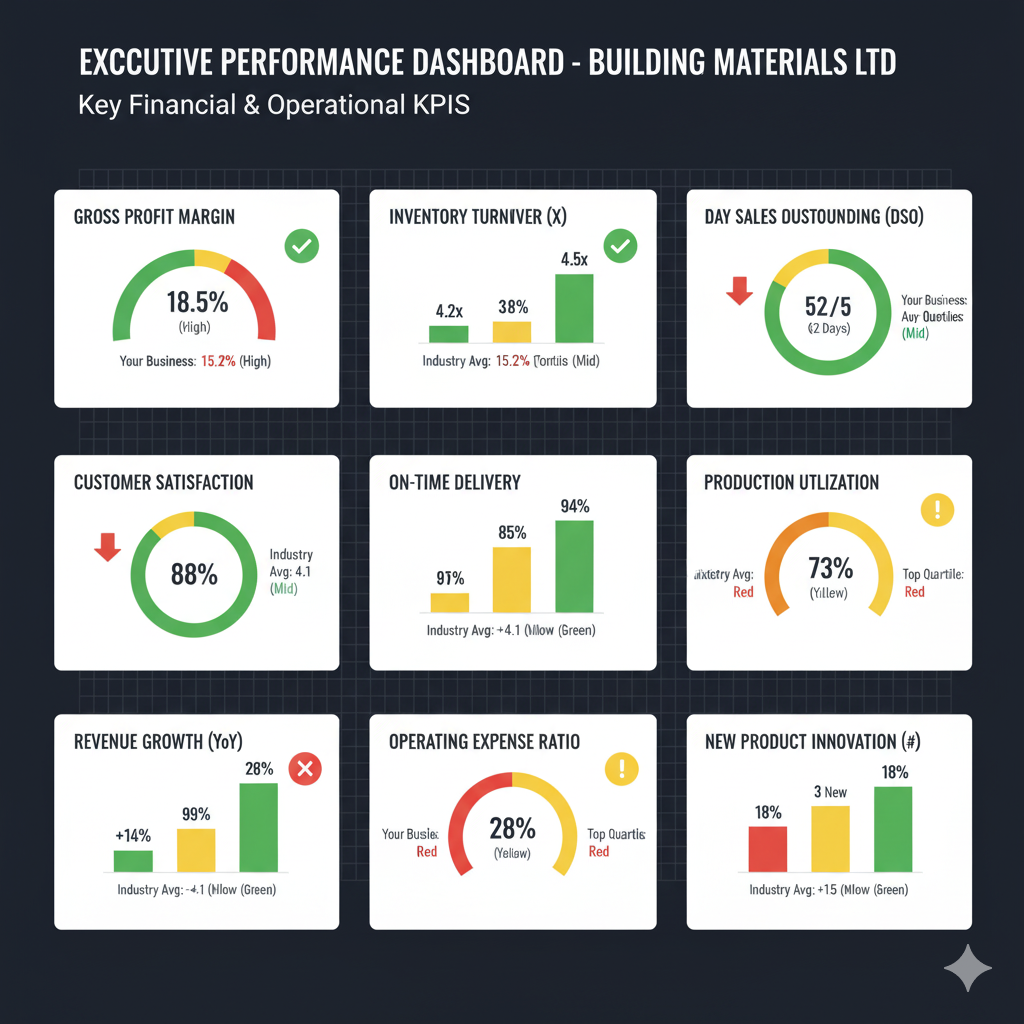

Performance Measurement and Continuous Improvement

What gets measured gets managed. Establish key performance indicators that provide early warning signs of profitability threats and opportunities for improvement.

Critical Profitability Metrics

Gross Margin by Product Category: Track monthly gross margins for each major product category. Declining margins often signal the need for pricing adjustments or supplier renegotiations before they significantly impact overall profitability.

Inventory Turnover Ratios: Calculate quarterly inventory turnover for each product category. Industry benchmarks suggest 4-6 turns annually for fast-moving items like cement, 3-4 turns for steel products, and 2-3 turns for specialty materials.

Customer Profitability Analysis: Measure profitability by customer segment, considering not just gross margins but also payment terms, service costs, and relationship stability. Some high-volume customers with extended payment terms may be less profitable than smaller customers who pay promptly.

Market Share and Pricing Position: Track your pricing relative to competitors for key products. Being consistently 10-15% above market suggests strong value proposition and customer loyalty, while being 20%+ above may indicate pricing vulnerability.

Continuous Improvement Framework

Implement monthly profitability reviews that examine:

- Product performance: Which categories are gaining/losing profitability?

- Customer trends: Are payment patterns improving or deteriorating?

- Operational efficiency: Are costs per transaction increasing?

- Market position: How are competitor strategies affecting your business?

Use these reviews to make incremental improvements rather than waiting for major problems to require dramatic changes.

Advanced Strategies for Market Leaders

Once you’ve mastered the fundamental profitability management strategies, advanced techniques can create sustainable competitive advantages that are difficult for competitors to replicate.

Value-Added Services and Margin Enhancement

Transform from a basic supplier to a construction partner by offering services that command premium pricing:

Technical Consultation Services: Provide material specification consulting for complex projects. Many contractors will pay 5-10% premium for suppliers who can recommend optimal materials for specific applications and help prevent costly mistakes.

Project Management Support: Offer materials scheduling and delivery coordination for large projects. This service typically commands 3-7% premium pricing while creating stronger customer relationships and more predictable revenue streams.

Financing Solutions: Partner with microfinance institutions or develop internal financing programs for creditworthy customers. This creates customer loyalty while generating additional revenue through financing margins.

Market Intelligence and Competitive Positioning

Price Leadership vs. Price Following: Determine whether your business model benefits from leading price changes or following market movements. Price leaders can improve margins but face customer resistance, while price followers maintain relationships but may see compressed margins during cost increases.

Exclusive Distribution Arrangements: Negotiate exclusive territorial rights with selected suppliers, particularly for specialized products. This creates local monopolies that support premium pricing while providing suppliers with dedicated market development.

Private Label Opportunities: Develop private label relationships with manufacturers for selected product categories. This typically improves margins by 8-15% while creating differentiation from competitors.

Conclusion and Next Steps

Maintaining profitability in Nigeria’s volatile building materials market requires systematic approaches that go far beyond basic business practices. The most successful operators combine dynamic pricing strategies, robust cash flow management, strategic supplier relationships, and continuous performance monitoring to create sustainable competitive advantages.

The key to long-term success isn’t avoiding volatility—it’s building systems that turn market uncertainty into profitable opportunities. Start by implementing the foundational strategies outlined here: dynamic pricing with volatility buffers, 90-day cash flow forecasting, ABC inventory analysis, and diversified supplier networks.

Remember that profitability management is an ongoing process, not a one-time solution. Market conditions will continue evolving, and your strategies must evolve accordingly. The frameworks and tools presented here provide the foundation for profitable operations regardless of market conditions.

Implementation Checklist

- [ ] Implement dynamic pricing system with volatility buffers

- [ ] Establish 90-day rolling cash flow forecasting

- [ ] Conduct ABC analysis of current inventory

- [ ] Diversify supplier base and negotiate strategic partnerships

- [ ] Set up key performance indicator tracking systems

- [ ] Develop risk management protocols for common scenarios

- [ ] Create monthly profitability review schedule

Author Bio

Mubarak Saidu brings about a decade of hands-on experience in Nigeria’s building materials industry, spanning sourcing, negotiations, marketing, and relationship management from both procurement and sales perspectives. Having managed inventory, accounts, and supplier networks across major Nigerian markets, Mubarak provides practical insights drawn from real-world experience in this dynamic sector.