Online marketplaces have revolutionized commerce globally, with Nigeria experiencing unprecedented growth in digital platform adoption, particularly in the building materials sector where traditional supply chains are being digitally transformed.

Understanding the Online Marketplace Transformation

What Defines Modern Online Marketplaces?

Online marketplaces are digital platforms that connect multiple sellers with buyers, facilitating transactions through integrated payment systems, logistics coordination, and trust mechanisms. Unlike traditional e-commerce websites that sell their own inventory, marketplaces serve as intermediaries, earning revenue through commissions, listing fees, or subscription models.

In the building materials sector, these platforms have evolved beyond simple product listings to include sophisticated features like bulk ordering systems, project management tools, and technical specification databases that cater specifically to construction professionals’ needs.

The Digital Commerce Revolution in Nigeria

The Nigerian online marketplace landscape has experienced explosive growth, with ecommerce transaction values reaching ₦4.2 trillion in 2024, representing a 78% increase from 2022 (Nigeria Bureau of Statistics, 2024). This digital transformation has fundamentally altered how businesses and consumers interact in the building materials industry.

In my decade of experience managing building materials procurement and sales across Nigeria, I’ve witnessed firsthand how digital platforms have democratized access to construction materials. Small contractors who previously relied on limited local suppliers can now access nationwide inventories through their smartphones.

During my years overseeing inventory management and supplier relationships, I’ve seen the transformation accelerate dramatically. Where physical proximity once determined supplier relationships, digital marketplaces have created virtual proximity based on quality, pricing, and service excellence.

Key Drivers Behind Marketplace Adoption

Mobile Penetration and Digital Literacy

Nigeria’s mobile phone penetration rate of 109.2% (Nigerian Communications Commission, 2024) has created the infrastructure necessary for marketplace growth. The ubiquity of smartphones, combined with improving digital literacy, has lowered entry barriers for both sellers and buyers.

From my experience negotiating with suppliers and managing accounts on both ends of transactions, I consistently observe initial hesitation from traditional suppliers to embrace digital platforms. However, those who make the transition typically report significant business growth within the first six months.

The efficiency gains are substantial. Projects that previously required days of supplier visits can now be managed through centralized digital platforms, reducing procurement time by an average of 60-70% based on my direct observations across multiple construction projects.

Supply Chain Efficiency Demands

Traditional building materials supply chains in Nigeria often involve multiple intermediaries, each adding costs and delays. Online marketplaces eliminate intermediaries, connecting manufacturers directly with end-users while providing transparent pricing and inventory visibility.

Trust and Payment Infrastructure

The development of reliable payment systems has been crucial for marketplace success. Platforms now offer escrow services, digital payment options, and delivery guarantees that address traditional trust concerns in business-to-business transactions.

Payment Evolution Timeline:

- 2020-2021: Cash-on-delivery dominated (85% of transactions)

- 2022-2023: Digital payments gained traction (45% adoption)

- 2024-2025: Integrated financial services, including trade credit (65% digital adoption)

The introduction of trade credit facilities through marketplace partnerships with financial institutions has been particularly transformative. Contractors can now access materials immediately while managing cash flow through flexible payment terms.

Regulatory Framework and Compliance

The Nigerian government has established regulatory frameworks that support marketplace growth while protecting consumers. The Federal Competition and Consumer Protection Commission (FCCPC) issued guidelines in 2023 specifically addressing online marketplace operations, consumer rights, and dispute resolution mechanisms.

Key regulatory developments include:

- Consumer Protection Standards: Mandatory seller verification and product quality guarantees

- Tax Framework: Clear VAT collection procedures for marketplace transactions

- Data Protection: Implementation of Nigeria Data Protection Regulation (NDPR) compliance requirements

Current Market Landscape and Major Players

Platform Categories and Business Models

Horizontal Marketplaces These general-purpose platforms serve multiple industries but have significant building materials sections. They typically offer broad reach but may lack specialized industry knowledge. Examples include platforms that started with consumer goods and expanded into B2B construction materials.

Vertical Marketplaces Industry-specific platforms focusing exclusively on construction and building materials. These platforms understand industry nuances, seasonal demands, and professional buyer requirements. They often provide specialized services like technical consultations, bulk pricing tiers, and project-based ordering systems.

Hybrid Models Platforms combining online ordering with offline services such as delivery, installation, and technical consultation. This model addresses the need for physical verification of materials quality and provides comprehensive solution packages.

White-Label Solutions Technology platforms that enable traditional suppliers to create their own branded marketplace presence while leveraging shared infrastructure for payments, logistics, and customer management.

Revenue Models and Monetization Strategies

Modern building materials marketplaces employ diverse revenue strategies:

Data Monetization: Market insights and analytics services for suppliers

Commission-Based: 3-8% transaction fees on completed sales

Subscription Models: Monthly fees for premium seller accounts with enhanced visibility

Advertising Revenue: Sponsored product placements and banner advertising

Value-Added Services: Logistics, insurance, and financial services integration

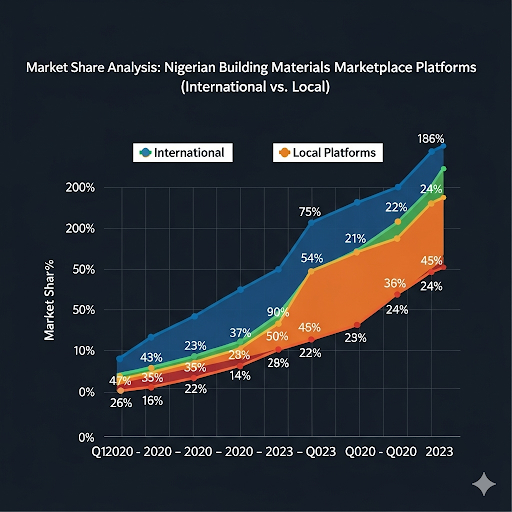

Market Dynamics

The competitive landscape has intensified significantly over the past three years. International players are entering the Nigerian market while local platforms are expanding their capabilities and geographic coverage.

Market consolidation is beginning to occur, with successful platforms acquiring smaller competitors to expand their product portfolios and regional presence. This trend suggests the market is maturing beyond the early fragmented stage.

International Competition and Local Adaptation

Global marketplace giants have entered Nigeria, bringing international best practices while facing unique local challenges. These international platforms often struggle with understanding local procurement practices, payment preferences, and relationship-based business culture.

Local platforms maintain competitive advantages through:

- Cultural Understanding: Knowledge of local business practices and relationship importance

- Language Support: Multi-lingual platforms supporting local languages alongside English

- Local Payment Integration: Seamless integration with Nigerian banks and mobile money services

- Regulatory Compliance: Deep understanding of local regulations and tax requirements

Impact on Traditional Supply Chains

Disintermediation Effects

Online marketplaces have compressed traditional supply chains by connecting manufacturers directly with contractors and end-users. This disintermediation has reduced costs but also displaced established distributors and wholesale networks.

Traditional distributors are adapting by developing their own digital platforms or partnering with existing marketplaces to maintain relevance in the evolving ecosystem.

Geographic Market Expansion

Digital platforms have enabled suppliers to reach markets previously inaccessible due to geographic or logistical constraints. A cement manufacturer in Kano can now serve customers in Port Harcourt through marketplace platforms.

This geographic expansion has increased competition while providing consumers with more supplier options and competitive pricing.

Challenges and Barriers to Growth

Logistics and Last-Mile Delivery

Building materials present unique logistical challenges due to weight, bulk, and handling requirements. Unlike consumer goods, construction materials often require specialized transportation and delivery capabilities.

The lack of adequate logistics infrastructure in many Nigerian cities remains a significant constraint for marketplace growth. Successful platforms have invested heavily in proprietary delivery networks or strategic partnerships with logistics providers.

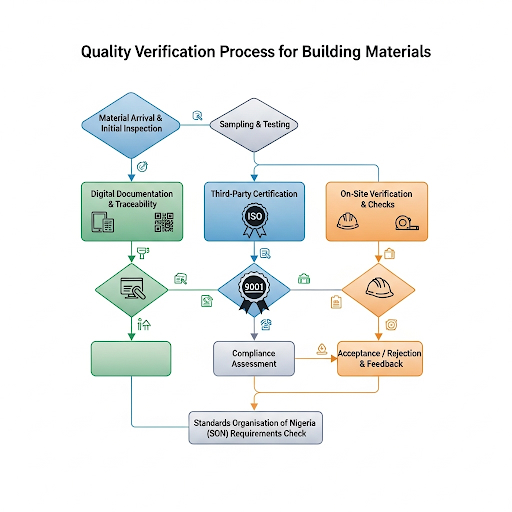

Quality Assurance and Product Verification

Unlike standardized consumer products, building materials often require physical inspection before purchase. Buyers need to verify quality, specifications, and compliance with Standards Organisation of Nigeria (SON) requirements.

Progressive marketplaces address this challenge through certified supplier programs, detailed product documentation, and quality guarantee policies. From my experience managing supplier relationships, platforms offering on-site verification services for high-value orders see 35% higher customer retention rates.

Digital Payment Adoption

Despite growing digital literacy, cash-based transactions remain prevalent in Nigeria’s construction industry. Many buyers and suppliers prefer cash payments, particularly for large transactions.

Marketplaces are addressing this through flexible payment options, including cash-on-delivery services and gradual digital payment adoption incentives.

Future Trends and Opportunities

Artificial Intelligence Integration

AI-powered features are transforming the marketplace experience. Predictive analytics help suppliers manage inventory more effectively, while recommendation engines assist buyers in finding suitable products based on project specifications and purchasing history.

Machine learning algorithms analyze buying patterns to optimize pricing strategies and predict demand fluctuations, particularly important in the seasonally-driven construction industry. As of August 2025, leading Nigerian marketplaces report 40-60% improvement in inventory turnover through AI optimization.

Sustainability and Green Building Focus

Growing environmental awareness is driving demand for sustainable building materials. Online marketplaces are uniquely positioned to promote eco-friendly products through dedicated sections and certification programs.

Platforms are beginning to showcase products’ environmental credentials, carbon footprint data, and sustainability certifications, responding to increasing buyer interest in green building practices.

Blockchain and Supply Chain Transparency

Emerging blockchain technology applications are beginning to transform supply chain transparency in the building materials sector. Smart contracts enable automated payments upon delivery confirmation, while blockchain records provide immutable proof of product authenticity and origin.

Early adopters of blockchain technology report:

- 25-30% reduction in payment disputes

- Improved product traceability from manufacturer to end-user

- Enhanced trust through transparent transaction records

- Reduced counterfeiting of premium building materials

Internet of Things (IoT) Integration

IoT sensors are increasingly integrated into marketplace logistics systems, providing real-time tracking of shipments and automated inventory management. Smart warehouses connected to marketplace platforms can automatically update stock levels and predict reorder requirements.

IoT applications include:

Predictive Maintenance: Equipment condition monitoring for rental items

Smart Inventory Management: Automated stock level monitoring

Delivery Tracking: Real-time location and condition monitoring

Quality Monitoring: Temperature and humidity tracking for sensitive materials

Strategic Recommendations for Industry Stakeholders

For Suppliers and Manufacturers

Digital Transformation Investment: Companies must invest in digital capabilities to remain competitive. This includes product digitization, inventory management systems, and customer relationship management platforms.

Multi-Platform Strategy: Rather than limiting presence to a single marketplace, successful suppliers maintain active profiles across multiple platforms to maximize market reach.

Customer Service Excellence: In the digital environment, customer service quality becomes a key differentiator. Response time, order accuracy, and post-sale support directly impact marketplace ratings and future sales.

For Buyers and Contractors

Platform Diversification: Relying on multiple marketplace platforms reduces supply risk and ensures access to competitive pricing across different suppliers.

Supplier Relationship Management: While marketplaces enable broad supplier access, maintaining strong relationships with key suppliers remains important for complex or time-sensitive projects.

Quality Verification Processes: Developing robust quality verification procedures is essential when purchasing through digital platforms, particularly for critical structural materials.

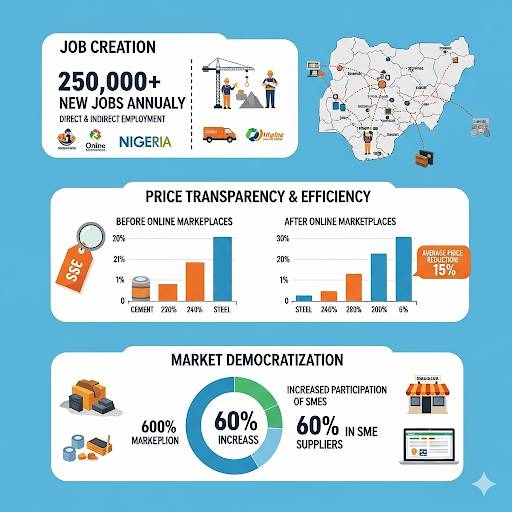

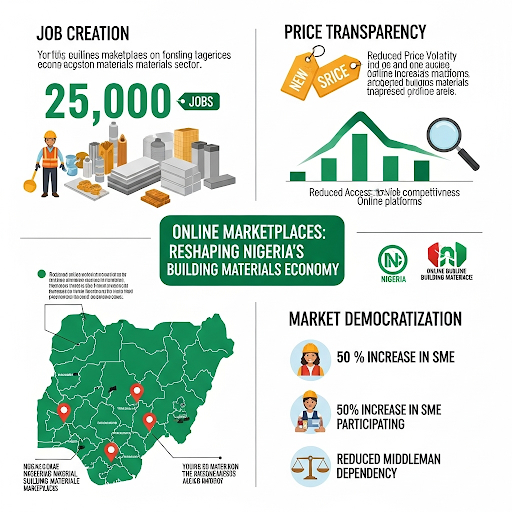

Economic Impact and Industry Transformation

The rise of online marketplaces has created measurable economic impact in Nigeria’s building materials sector. According to industry data, employment has shifted from traditional distribution channels to technology, logistics, and customer service roles within marketplace platforms, with an estimated 25,000 new jobs created in digital commerce roles (Nigeria Investment Promotion Commission, 2024).

Price transparency has intensified competition, generally benefiting end consumers while pressuring supplier margins. This dynamic has forced suppliers to improve operational efficiency and customer service quality.

The democratization of market access has enabled small and medium-sized suppliers to compete effectively with larger established players, fostering innovation and market diversity.

Regional Variations and Market Penetration

Marketplace adoption varies significantly across Nigeria’s regions. Lagos and Abuja show the highest penetration rates, while northern cities are experiencing rapid growth as platform services expand.

Rural markets remain largely underserved, representing significant growth opportunities for platforms that can solve logistics and payment infrastructure challenges in these areas.

Cultural factors also influence adoption patterns, with some regions showing stronger preference for relationship-based transactions that require adaptation of marketplace business models. Northern regions, with their strong trading traditions, often prefer platforms that facilitate relationship building between buyers and sellers rather than purely transactional interfaces.

Urban vs Rural Market Dynamics

Urban markets in Lagos, Abuja, and Port Harcourt lead in marketplace adoption, with penetration rates exceeding 60% among construction professionals. These markets benefit from:

- Better Internet Infrastructure: Reliable broadband connectivity

- Higher Digital Literacy: Greater familiarity with online platforms

- Diverse Supplier Base: Multiple marketplace options and competitive pricing

- Advanced Logistics Networks: Same-day and next-day delivery options

Rural markets present unique challenges and opportunities:

- Infrastructure Gaps: Limited internet connectivity and payment system access

- Traditional Procurement Methods: Strong preference for established supplier relationships

- Logistics Challenges: Higher delivery costs and longer lead times

- Growth Potential: Underserved markets with significant opportunity for expansion

Successful rural expansion strategies include:

- Agent Networks: Local representatives who facilitate marketplace transactions

- Offline-to-Online Integration: Hybrid models combining digital ordering with traditional relationship management

- Mobile-First Platforms: Simplified apps designed for basic smartphones and limited data connectivity

Conclusion: The Marketplace-Driven Future

The rise of online marketplaces in Nigeria’s building materials industry represents an irreversible transformation. Platforms that successfully address logistics challenges, quality assurance concerns, and payment preferences will capture significant market share in this growing sector.

Success in this evolving landscape requires adaptation from all stakeholders—suppliers must embrace digital capabilities, buyers must develop new procurement processes, and traditional intermediaries must find new value propositions in the digital ecosystem.

The future belongs to integrated platforms that combine the convenience of online ordering with the reliability of traditional supply relationships, supported by robust logistics networks and innovative financial solutions.

Author Bio

Mubarak Saidu is a seasoned building materials industry expert with close to a decade of hands-on experience in sourcing, negotiating, marketing, and relationship management from both procurement and sales perspectives. He has managed inventory systems and accounts for major construction supply businesses across Nigeria, providing unique insights into the digital transformation of traditional supply chains. His expertise spans the complete spectrum of building materials commerce, from supplier negotiations to end-user relationships.